There are possibilities of financing the defence industry in the Czech Republic

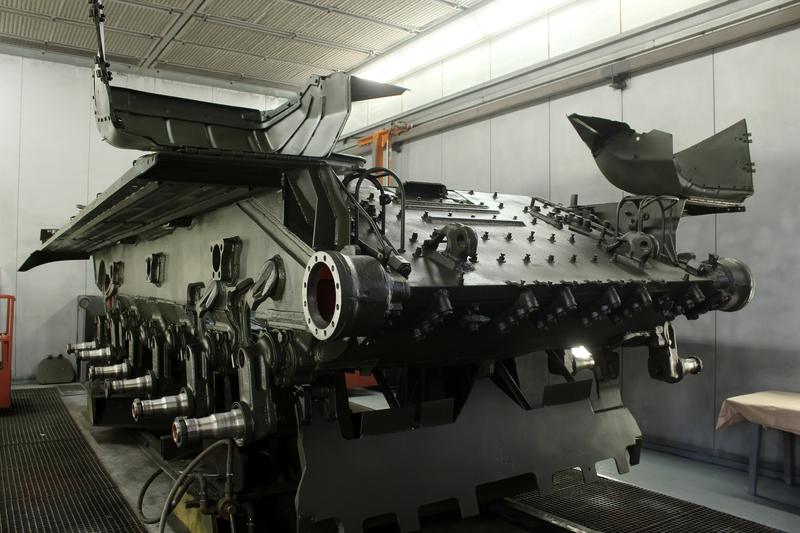

The need for bank support for the Czech defence industry is growing. There are two reasons. Firstly, because of the international security situation defined by the war in Ukraine, the conflict in the Gaza Strip and terrorist threats, and secondly, because of the need to make up for the loss in the Czech Republic's defence capability. While our membership of the North Atlantic Treaty Organisation certainly provides guarantees, we ourselves must also be able to defend our own territory effectively. For this, we need sufficient and adequate military equipment, equipment and, of course, ammunition.

The unfavourable trend set at one point by EU rules is de facto changing at European level. However, the Czech defence industry is encountering certain problems with financing right here at home, with medium-sized enterprises suffering the most. The attitude of the state is determined by key documents, such as the Defence Strategy of the Czech Republic, which is linked to the Security Strategy of the Czech Republic, and the Minister of Defence, Jana Černochová, is thus negotiating with representatives of the banking sector, in particular the Czech Banking Association, on the approach to financing the defence industry. Representatives of the Defence Industry Section of the Czech Chamber of Commerce and the Association of Defence and Security Industry (AOBP) are present at the meetings and can provide immediate feedback on this matter. Increased demand from companies for bank loans is particularly needed in the area of production financing, for example for the purchase of scarce raw materials and semi-finished products, as even subcontracting chains have copied the downsizing of the defence industry over the last thirty years.

The Ministry of Defence is also working closely with the Ministry of Finance and other ministries to bring about a change, particularly at European level, which has made the defence industry 'dirty' over the past decades. This includes changing the policy of the European Investment Bank (EIB) so that it can also invest in military production. As František Šulc, 1st Deputy Minister of Defence, said at the March Round Table on this issue: 'We have advocated that the European Defence Agency (EDA) adopt a joint statement on the issue of access to finance for the defence industry. We worked together on the preparation of the European ASAP regulation, thanks to which two Czech companies received a grant. We are cooperating with TA ČR on the PRODEF programme."

The aim is to create optimal cooperation between the banking and public sectors. The state today requires the defence industry to undertake a number of administrative tasks (obtaining a licence) and security measures (including vetting) to regulate and control the market. The solution offered is that instead of banks regulating themselves and going through a virtually parallel vetting process with the state, they should trust the state more in this matter, which carries out this type of vetting thoroughly. Banks should then be more accommodating towards defence industry firms. Indeed, a meeting to this effect was held on 8 April at the Ministry of Defence between a group of experts and representatives of the Ministry of Defence, the Ministry of Finance, the Czech Banking Association (CBA) and the Czech defence industry. Prior to this meeting, at the request of the Ministry of Defence, the Defence Industry Section of the Czech Chamber of Commerce and the AOBP organised a survey among its members which clearly pointed to the specific problems faced by the defence industry. The problems are most often associated with banks that have foreign owners. The survey also showed that Czech defence industry companies are sometimes treated differently than companies from the country where the bank is based.

The shift in this discussion is that the Ministry of Defence will designate specific representatives who will be ready to deal with bankers on specific cases concerning the financing of the strategic needs of the state, which are important for ensuring the defence capability of the Czech Republic and for the modernisation of the Czech Army. The Ministry of Defence has also created a document in cooperation with the Defence Industry Section of the Czech Chamber of Commerce, the Ministry of Foreign Affairs and the Licensing Administration of the Ministry of Industry and Trade of the Czech Republic, which describes very clearly the whole process of controlling foreign trade in military material. Specifically, it deals with the granting of permits and licences for the export of military equipment, including how many institutions and authorities are involved in the process.

In all discussions, representatives of banks, the defence industry and the Ministries of Defence and Finance agree on the need for long-term support to the defence industry. As Marek Mora, former Deputy Chairman of the CNB and current Deputy Minister of Finance, said at the Round Table in the Chamber of Deputies on 26 March, direct state support is possible and important, but it is limited and cannot be done without the participation of commercial banks. "The Ministry of Finance has therefore submitted a draft law on the National Development Bank (NDB), which will make the CEB a subsidiary of the NDB. The law will also allow the issuance of NRB bonds with a state guarantee," the deputy minister said. It should be added that by the government's resolution of 29 November 2023 (No. 909) on the proposal to start the integration process of the National Development Bank, a.s. and the Czech Export Bank, a.s., it was decided that the CEB would become a 100% subsidiary of the NRB. The aim of the amendment to the Export Insurance and Financing Act is to allow the shares of CEB to be transferred to NRB, which is wholly owned by the State. Once this ownership integration of CEB and NRB is completed, CEB will thus be indirectly (through NRB) owned by the State. This is part of the Export Strategy of the Czech Republic 2023-2033, approved by Government Resolution of 26 July 2023 (No 559), which constitutes the basic strategic framework for state export support, including capital instruments, and is also the basis for the CEB's internal strategic documents. The integration of the state-owned banking institutions into one group will significantly strengthen the ability of the CEB to fulfil its key strategic objective, i.e. to contribute to the economic and social development of the Czech Republic, while at the same time it should in no way jeopardise the CEB's ability to meet the objectives set out in the Export Strategy of the Czech Republic for the period 2023-2033 approved by the Government in July 2023.

An important point of this change is in particular the fact that all modern and relevant countries have their development banks in order to fulfil their interest to develop their economy and the above described legislative process will create a development bank conceived in this way for the Czech Republic as well. Among other things, the National Development Bank will be exempted from CRD IV regulation and should be able to issue bonds with a state guarantee to raise new funds for financing projects in the form of "repayable financing". In the case of the defence industry, this is one of the solutions, as the NRB can go further than the interests of commercial banks. Simply put, the National Development Bank begins where the commercial banks end. Nevertheless, even after the merger with the Czech Export Bank, the National Development Bank will still be the smallest commercial bank in the country in terms of financing volume (for comparison, the German KFW is the 3rd largest bank in Germany).

The situation should improve by gaining the possibility to issue bonds with a state guarantee, but it is primarily a matter of the government's will to equip the National Development Bank to finance economic development. It is therefore up to the government and the Ministry of Finance to decide how to deal with this opportunity, including in the light of the defence strategy adopted. There is no doubt about the return on the funds.

The Export Guarantee and Insurance Corporation (EGAP) is another factor in supporting the domestic defence industry in the export sector, especially in the distribution of ammunition and military equipment. EGAP focuses on risks that are not insurable by the market and, using the example of the Ukraine measure, seeks to create a 'defence fund' from which funds could be used for defence projects in general, in any relevant country. EGAP insures credit risks with state support on the basis of Act No 58/1995 Coll. on Insurance and Financing of Exports with State Support and on Supplementing Act No 166/1993 Coll. on the Supreme Audit Office, as amended. In 2023, EGAP insured CZK 70 billion, which is 1% of GDP. The defence sector accounted for CZK 20 billion.

The insurance company also launched a new project in cooperation with the Ministry of Defence. There will be CZK 1 billion available for defence industry projects, which should practically generate CZK 10 billion for the defence industry, according to the principle that for 1 crown EGAP will generate CZK 10 for the defence industry. Furthermore, EGAP supports the creation of the so-called "2nd Circuit", which aims to enable the government to support by its resolution, on the basis of "national security interest", the financing of projects that otherwise could not be financed due to the limits set (e.g. territorial limit) for the given territories. To this end, the institute of "security interest" should be created in Act No 58/1995 Coll., on Insurance and Financing of Exports with State Support.

On the basis of these facts, it is clear that there is quite a lot that can be done for the Czech defence industry, regardless of the position of the European Investment Bank. The above-mentioned amendment concerning the NRB or EGAP activity will also cause changes in the approach of some ministries, such as the Ministry of Industry and Trade. In any case, in order for the private sector to be able to adapt and respond adequately, the state or the government should clearly define what it wants and how it wants it. The issue of the development of the defence industry is not a short-term goal, but should instead be a priority for years to come.