German defence industry on the rise: Armaments companies expand at home and abroad, and recording orders worth tens of billions of euros

The Swedish think tank SIPRI, in its latest report, highlighted a global increase in revenues for military technology manufacturers. While European arms companies saw only a slight overall improvement, four leading German firms managed to boost their revenues by 7.5%. Increased capital allowed industrial giants like Rheinmetall and Diehl to expand and scale up production, as evidenced by both domestic and international acquisitions. SIPRI anticipates that this trend will continue in the coming years, with further growth in the global arms trade.

Worldwide revenues from the sale of military equipment and services rose by 4.2% last year, reaching a total of $632 billion, according to SIPRI (Stockholm International Peace Research Institute). Companies based in the U.S. accounted for approximately half of these revenues ($317 billion) and recorded a 2.5% revenue increase compared to 2022. U.S. firms also dominate SIPRI’s ranking of the largest arms manufacturers by revenue, with 41 representatives among the top 100, including the top five positions.

Russian and Middle Eastern arms manufacturers also reported higher earnings. Russia, which has been waging an aggressive war against Ukraine since February 2022, saw state-owned conglomerate Rostec climb two spots to seventh place with a 49% increase in revenue, reaching $21.7 billion. Meanwhile, six Middle Eastern companies (three Israeli and three Turkish) in the top 100 collectively increased their arms sales by 18%. In Asia and Oceania, 23 firms recorded a modest 5.7% growth in revenue. European arms manufacturers, on the other hand, saw only minimal growth of 0.2%, reaching $133 billion. Many European companies were still fulfilling older contracts with longer delivery timelines, meaning their data has yet to reflect the impact of recent order increases.

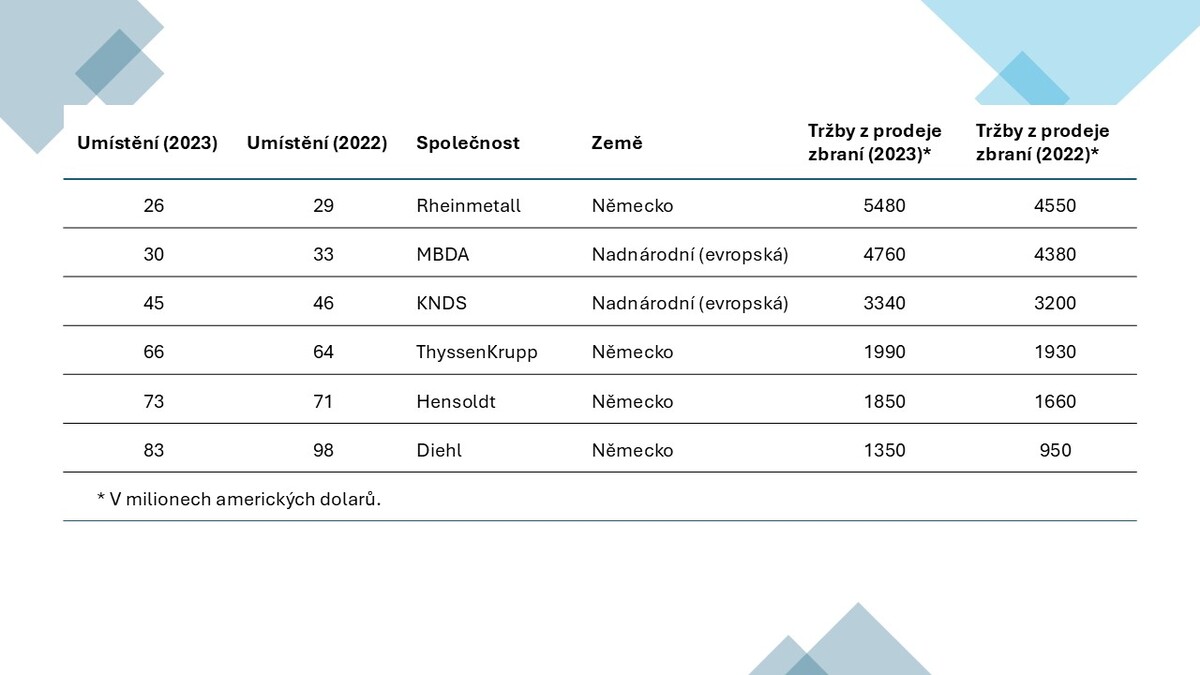

Among the SIPRI rankings are four German companies whose revenues outpaced those of other European military technology manufacturers, rising by 7.5% to $10.7 billion. The conglomerate Diehl jumped from 98th to 83rd place between 2022 and 2023, driven by strong sales of its air defense systems. Particularly in demand is the IRIS-T SLM system, which has proven highly effective in Ukraine. Given the Czech Republic’s participation in Germany’s European Sky Shield Initiative, which envisions member states utilizing Diehl products, it is plausible that IRIS-T systems could be introduced into the Czech armed forces in the future.

This November, Diehl laid the foundation stone for the expansion of its facility in Nonnweiler, which the company’s management expects will increase production capacity to meet "the continued rise in demand." The growth in business activities is also reflected in the workforce numbers. While Diehl Defence employed just under 2,800 people in 2021, the current number exceeds 4,400. “With the laying of the foundation stone at the Nonnweiler plant, Diehl Defence is beginning to implement its expansion plan,” stated Thomas Bodenmüller, CFO of Diehl Defence, on November 25. “The new production capacity will contribute to the defense capabilities of the Federal Republic of Germany and other countries.”

In the same month, Diehl Defence announced the acquisition of Dynamit Nobel GmbH (including its Troisdorf facility), along with all operational activities, employees, and assets. The transaction includes acquiring unique permits for the production of military detonators and incendiary materials. These critical components for Diehl Defence products have become increasingly indispensable for the security of Germany and allied nations since 2022.

Germany’s largest military technology manufacturer, Düsseldorf-based Rheinmetall, also moved up three spots to rank 26th. Since Russia’s invasion of Ukraine in early 2022, the company has been significantly expanding its production capabilities. For instance, this year Rheinmetall began constructing a new artillery munitions factory in Unterlüß, Lower Saxony. According to SIPRI, Rheinmetall’s arms sales revenue increased by 10% last year. This year, the Düsseldorf company reported record-breaking figures. In the first nine months of the year, it increased its revenue by an additional 36%, reaching €6.3 billion. Gross profit amounted to €705 million, a 72% increase compared to the same period last year.

"In light of the persistently high demand from the German armed forces and the armed forces of EU and NATO partner countries, as well as the ongoing support for Ukraine, the military trade market remains dynamic," the company stated. Rheinmetall also achieved a record order backlog, with pending orders valued at €52 billion. The German government alone is awaiting the delivery of €8.5 billion worth of artillery ammunition and 105 Leopard 2 A8 tanks for just under €3 billion. The strong performance of recent years has significantly boosted the company’s stock market valuation.

Czech soldiers are also eagerly anticipating additional Leopards. On December 3, the Czech Ministry of Defense signed a contract with Rheinmetall for the purchase of 14 Leopard 2 A4 main battle tanks. Rheinmetall Landsysteme GmbH will deliver the refurbished tanks by the end of 2026. The contract, worth CZK 3.98 billion (excluding VAT), includes the integration of communication and information systems, workshop equipment, related materials, and an initial supply of ammunition. According to the German website hartpunkt, the tanks are likely former Swiss Army vehicles, purchased by Rheinmetall under the condition that they not be transferred to Ukraine. Additionally, the German government has promised Prague 28 Leopard 2 A4 tanks and two Büffel 3 armored recovery vehicles as part of a ring exchange program supporting Ukraine. Approximately half of these vehicles have already been delivered, with the remainder expected by the end of 2025. In exchange for Western technology, the Czech Republic provided Ukraine with Soviet-designed tanks and other equipment. The Czechs are also finalizing negotiations with the Leopard manufacturer for a maintenance agreement that would ensure their future upkeep by Czech companies on Czech soil.

Once the above deliveries are complete, the Czech Army will have a total of 42 Leopard 2 A4 tanks. Prague also plans to acquire up to 77 Leopard 2 A8 tanks (61 tanks for CZK 39.8 billion including VAT, with an option for an additional 16 vehicles for CZK 12.3 billion) in six different configurations: main battle tank, command tank, recovery vehicle, bridge-laying tank, engineering tank, and driver training tank.

As evidenced by its November acquisition of the American firm Loc Performance Products, Rheinmetall is succeeding beyond Europe as well. The German company paid $950 million for the Michigan-based arms manufacturer, which will now be renamed American Rheinmetall Vehicles. With this strategic transaction, Rheinmetall strengthens its position in the world’s largest defense market and enhances its production capacity for land vehicles for military customers worldwide. Loc Performance Products is known for its advanced manufacturing, machining, and welding technologies, which meet the production needs of U.S. Army programs. Along with these capabilities, Rheinmetall gains over 1,000 skilled employees with expertise in maintaining, repairing, and upgrading military combat vehicles.

For the sake of completeness, it is worth noting that other German military technology manufacturers saw only slight increases in revenue compared to their competitors, resulting in relative declines on the SIPRI ranking. Hensoldt benefited from rising demand for defensive systems against missiles, guided weapons, and drones. The radar and sensor systems manufacturer ranked 73rd, dropping two spots, as did submarine maker Thyssenkrupp Marine Systems of Kiel (ranked 66th). The KNDS group, a joint venture between Munich-based Krauss-Maffei Wegmann and France’s Nexter Group, came in at 45th place. MBDA (Matra BAe Dynamics Aérospatiale), the European missile giant with a strong presence in Germany, secured 30th place.

The Czech group Czechoslovak Group (CSG) made a significant leap on the SIPRI ranking, climbing to 89th place from 107th in 2022. According to SIPRI, CSG’s revenue from arms sales grew by 25.3% last year compared to 2022. Given the recent major acquisition of The Kinetic Group division, which includes prestigious American small-caliber ammunition brands such as Remington, Federal, and CCI Ammunition, further substantial revenue growth is expected for the group.

According to SIPRI expert Lorenzo Scarazzato, the significant growth in defense industry sales is expected to continue into 2024. Current revenues do not yet fully reflect the scale of demand from recent years and months, and many companies are continuing to hire new employees. This indicates that German and other arms manufacturers remain confident in their future sales. A very promising and profitable period lies ahead for Western military technology producers.